Investec Reserves £30 Million as FCA Investigates Motor Finance Commissions

- News

- 04 November 2025

Admin admin

Admin admin

Admin admin

Admin adminInvestec, a London-listed South African banking group with approximately 1,600 bankers in London, reserves £30 million to cover potential compensation and other related costs and fees as the Financial Conduct Authority probes the historical motor finance commission arrangements and sales practices of financial firms in the UK.

However, despite the allocation for the potential ruling of the FCA, the firm strongly believes that they only received few complaints related to the practice of discretionary commission arrangements (DCAs).

“Nevertheless, the group recognises that costs and awards could arise in the event that the FCA concludes there has been industry wide misconduct and customer loss that requires remediation,” the firm said. “Those costs and awards could arise as the result of a redress scheme, or from adverse FOS/litigation decisions.”

Amid this potential losses of the firm, Investec remains positive as they have reported a five per cent increase in their operating income. “Revenue momentum is expected to continue, underpinned by book growth, stronger client activity levels and success in our client acquisition strategies; partly offset by expected cuts in interest rates”, said Investec.

Investec began investing in the UK motor finance market in 2015. As of 2021, it has recorded a total of £555 million in booked business, equivalent to 1% of the market share.

In 2024, Investec declared a record dividend of 19 pence per share, equivalent to 34.5 pence per share. The firm attributed this to the high interest rates that boosted its net income.

The Financial Conduct Authority is examining the practice of financial firms in the Discretionary Commission Agreement (DCA). The DCA allows car dealerships to earn more by raising the interest rates for the buyer. This was banned in 2021 because it only incentivized car dealers. This gave car dealers the option to select higher rates, benefiting both the dealers and the banks.

The FCA is reviewing deals made between April 2020, when the Financial Ombudsman Service started to oversee the DCA, and January 2021, when it was banned.

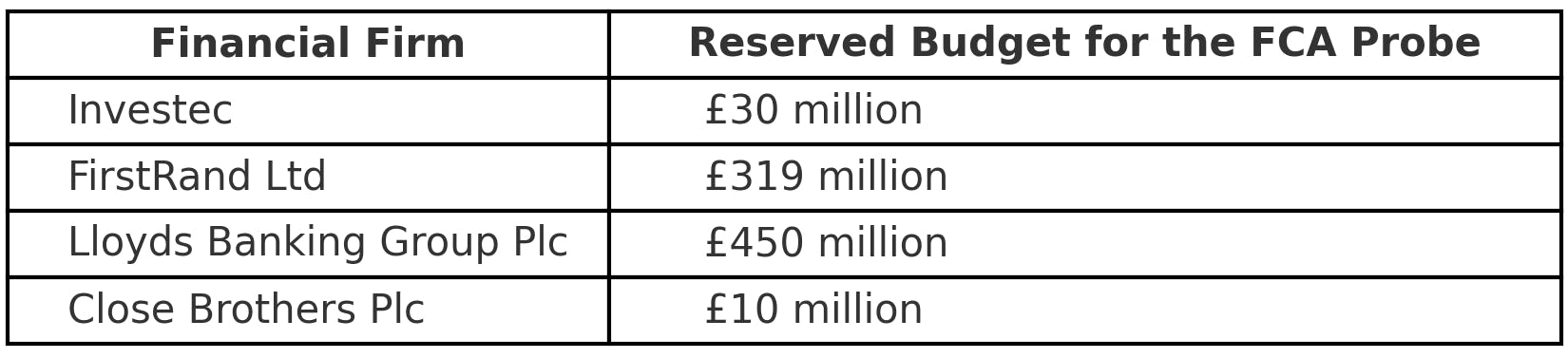

Aside from the £30 million of Investec, other financial firms have also set aside a budget for the potential costs of the FCA’s probe.

FirstRand Ltd, South Africa’s largest bank by market value, has allocated £319m for the related costs for its MotorNovo units in February.

In March, Lloyds Banking Group Plc reserved £450 million in anticipation of potential costs, such as legal fees, compensation for affected consumers, or fines, resulting from FCA’s investigation.

The Close Brothers hopes to set aside £400 million by bolstering its finances in response to the probe.

The Financial Conduct Authority issued a letter to motor finance firms stating that they “must maintain adequate financial resources at all times” while the investigation is ongoing.

The FCA also observed that financial firms are taking different approaches to account for the potential impact of their previous use of the Discretionary Commission Agreement (DCA) on their financial resources.

This was after months of speculation about the scope of the investigation in motor finance DCA and its financial impact on the financial firms that will be required to provide compensation.

Financial firms' plans should include all the potential additional operational costs from increased complaints and the costs of resolving those complaints.

Financial firms need to be more than ready for the outcomes of this probe, for the deals being reviewed are from 2017 to 2021.

Despite the FCA's current investigation, Investec continues to perform well in the market. In 2024, Investec declared a record dividend of 19 pence per share, up from 34.5 pence per share, “Thanks to higher global interest rates,” according to them. This allowed the firm to reserve £30m for potential fees and costs after the investigation.

On the other hand, Lloyds made a £450m provision for the potential impact of the investigation. This amount will be allocated to the estimated costs and potential redress of the investigation. The firm is also open to the idea that this amount might increase as the investigation progresses. They even believe that it could rise to £2bn.

While Investec and Lloyds are confident about addressing the investigation's financial repercussions, Close Brothers seems to struggle financially. Their shares have collapsed by over two-thirds since the FCA published the reviews.

Based on the analysis, Close Brothers is currently expecting up to £200m in compensation payouts. The firm has already scrapped its dividend for 2024 to help fund the redress and might also freeze 2025’s distribution.

Further, other firms not exposed to the DCA probe have warned about higher costs. S&U, the specialist auto and property lender, said that while it never engaged in DCAs, the firm reached a sum of £8.2m in increase in financial provision. This provision aligns with the IFRS 9 accounting rules that require lenders to account for potential losses based on expected cash flows.

According to RBC, an investment bank, the estimated liability of the motor finance industry is £8 billion, based on all the funds these financial firms reserve. This amount was later raised to £16 billion.

“We received a small number of complaints.”

This is according to Investec as regards the probe about its use of DCA. They believe their use of DCA was compliant with the laws and regulations at the time.

While confident about how they applied DCA in their previous deals, they still recognize the potential costs and fees after the FCA probe.

“Nevertheless, the group recognizes that the costs and awards could arise in the event that the FCA concludes there has been industry widespread misconduct and customer loss that requires remediation,” according to them.

They added, “These costs and awards could arise as the result of a redress scheme, or from adverse FOS and/or litigation decisions.”

“We feel that it is prudent to take a provision.”

This is according to Ruth Leas, Head of Investec's main banking subsidiary. The firm announced the £30m that it reserved for potential costs and fees after the FCA probe.

“We acknowledge significant uncertainty around this estimation and will need to wait for the FCA’s review outcome later this year,” she added.

While the FCA probe is alarming to financial firms, Investec remains optimistic about its future success in the financial market. Where is Investec headed?

Investec is restructuring its operations to focus on its core activities, making them more efficient and profitable.

Investec separates its asset management business, which handles investments on behalf of clients, by making it a standalone company - Ninety One Ltd. Through this, Investec could allow the new company to focus solely on asset management. At the same time, Investec concentrates on other areas, such as banking.

Investec’s wealth management division has merged with Rathbones Group, a UK-based management firm. This merger allows Investec to expand its wealth management services and strengthen its position in the UK market.

Investec set new financial goals for the next few years. Two specific targets are-

This proactive move of Investec reflects their commitment to adhering to whatever the ruling of the Financial Conduct Authority as regard the application of the discretionary commission arrangements. While the probe poses potential income loss for Investec, the firm remains confident about their growth and stability in the financial market.

The Financial Ombudsman Services (FOS) is currently reviewing 20,000 complaints related to car finance commission cases. Most of these cases involve unfair arrangements of agreement and a lack of transparency in the commission of the broker. The outcomes of these cases could potentially set new precedents that will reshape how commissions are managed and disclosed, leading to potential changes in the regulations that will enforce more transparent practices in the car finance industry.

The Financial Ombudsman Service (FOS) cited approximately 20,000 car finance commission complaints as consumers realized that they were charged of hidden commissions in their car finance agreements. The FOS reported that majority of these cases involved unfair car finance agreement and undisclosed dealer commission. The results of the investigation of these cases could potentially shape future decisions and ruling of the FOS.

The UK car finance scandal has revealed widespread problems with mis-sold car finance, from hidden commissions to inflated interest rates. Thousands of drivers are now exploring car finance claims and using a PCP claim check to see if they could be due car loan compensation. This guide explains the most common car finance issues, the latest updates for 2025, and what steps to take if you believe your agreement was mis-sold.

The UK car finance scandal has revealed widespread problems with mis-sold car finance, from hidden commissions to inflated interest rates. Thousands of drivers are now exploring car finance claims and using a PCP claim check to see if they could be due car loan compensation. This guide explains the most common car finance issues, the latest updates for 2025, and what steps to take if you believe your agreement was mis-sold.

The UK car finance scandal has revealed widespread problems with mis-sold car finance, from hidden commissions to inflated interest rates. Thousands of drivers are now exploring car finance claims and using a PCP claim check to see if they could be due car loan compensation. This guide explains the most common car finance issues, the latest updates for 2025, and what steps to take if you believe your agreement was mis-sold.

The UK car finance scandal has revealed widespread problems with mis-sold car finance, from hidden commissions to inflated interest rates. Thousands of drivers are now exploring car finance claims and using a PCP claim check to see if they could be due car loan compensation. This guide explains the most common car finance issues, the latest updates for 2025, and what steps to take if you believe your agreement was mis-sold.